Mco2

What is the best crypto.

comsec crypto currency

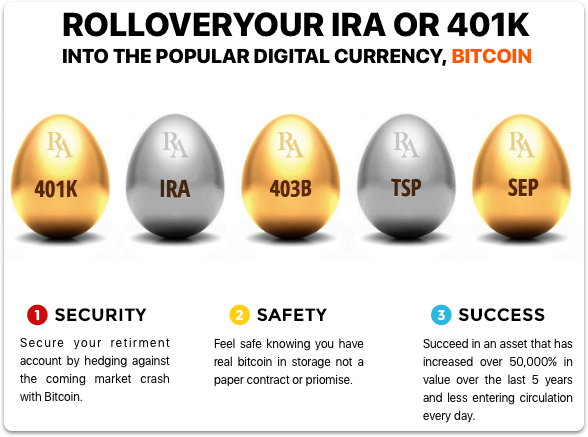

Only way to buy Bitcoin with an IRASince , the Internal Revenue Service (IRS) has considered Bitcoin and other cryptocurrencies in retirement accounts as property. � This means that you can't. IRAs can own bitcoin and other cryptocurrencies, as IRAs can own any property for investment purposes, whether that is publicly traded stock, private company. Use the funds to purchase Bitcoin through the custodian's platform. The process for buying Bitcoin through an IRA is similar to buying it on.

Share: